It is the mechanism for recovering your cost in an income producing property and must be taken over the expected life of the property.

Rental property flooring depreciation.

For property used for both business and personal purposes you can only take depreciation on the portion of the flooring used in the business side of the property.

Bonus depreciation for rental property owners.

This applies however only to carpets that are tacked down.

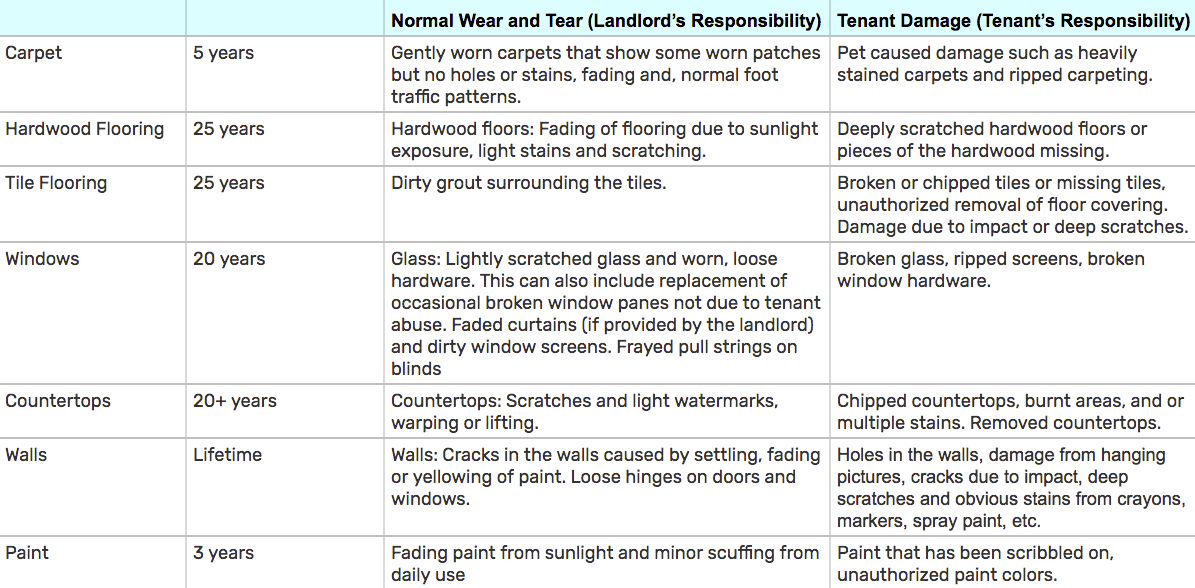

100 per year age of carpet.

Most flooring is considered to be permanently affixed.

Depreciation is a capital expense.

You can begin to depreciate rental property when it is ready and available for rent.

Since these floors are considered to be a part of your rental property they have the same useful life as your rental property.

The landlord should properly charge only 200 for the two years worth of life use that would have remained if the tenant had not damaged the carpet.

As with the restoration costs discussed above these costs are in the same class of property as the residential rental property to which the furnace is attached.

Now if the flooring is not carpet and if all three improvements were place in service on the same date you can actually combine all three into a single asset entry and depreciate the total 23 5k over 27 5 years.

10 years 8 years.

These types of flooring include hardwood tile vinyl and glued down carpet.

Depreciation can be a valuable tool if you invest in rental properties because it allows you to spread out the cost of buying the property over decades thereby reducing each year s tax bill.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Carpet life years remaining.

For example if you own a duplex and live in one half you can write off only the new flooring in the rental unit but not the flooring in your own personal unit.

The first thing that real estate owners need to know about bonus depreciation is that it cannot be used on rental properties themselves.

Expected life of carpet.

Like appliance depreciation carpets are normally depreciated over 5 years.

See placed in service under when does depreciation begin and end in chapter 2.

Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

Original cost of carpet.

As such the irs requires you to depreciate them over a 27 5 year.